How Pkf Advisory Services can Save You Time, Stress, and Money.

How Pkf Advisory Services can Save You Time, Stress, and Money.

Blog Article

A Biased View of Pkf Advisory Services

Table of ContentsSome Ideas on Pkf Advisory Services You Need To KnowThe 9-Second Trick For Pkf Advisory ServicesExcitement About Pkf Advisory ServicesEverything about Pkf Advisory ServicesGetting My Pkf Advisory Services To Work

The majority of people nowadays realise that they can not count on the state for greater than the absolute essentials. Planning for retirement is an intricate organization, and there are several options readily available. A financial adviser will certainly not only assist sort via the lots of regulations and product options and assist construct a profile to increase your lengthy term leads.

Acquiring a house is among the most pricey choices we make and the huge bulk of us need a home mortgage. An economic consultant could save you thousands, especially at times such as this. Not only can they look for the ideal prices, they can assist you assess reasonable degrees of loaning, make the many of your deposit, and could likewise discover lenders who would or else not be available to you.

The Ultimate Guide To Pkf Advisory Services

An economic adviser knows how items operate in various markets and will certainly identify possible downsides for you along with the possible benefits, to make sure that you can after that make an enlightened choice concerning where to invest. Once your danger and financial investment assessments are full, the following step is to look at tax; also one of the most standard summary of your setting can assist.

For a lot more challenging arrangements, it might suggest moving assets to your partner or children to maximise their individual allocations rather - PKF Advisory Services. A financial advisor will certainly always have your tax placement in mind when making recommendations and point you in the appropriate direction even in complex scenarios. Also when your investments have been implemented and are going to plan, they ought to be kept track of in case market developments or uncommon occasions press them off course

They can assess their performance against their peers, make certain that your asset allotment does not come to be altered as markets fluctuate and help you consolidate gains as the deadlines for your best goals relocate better. Money is a difficult subject and there is whole lots to think about to secure it and make the many of it.

The Buzz on Pkf Advisory Services

Utilizing a great economic consultant can cut via the buzz to steer you in the appropriate direction. Whether you require general, sensible advice or a specialist with committed competence, you might find that in the long-term the cash you spend in skilled guidance will certainly be repaid lot of times over.

Keeping these licenses and qualifications requires constant education, which can be expensive and time-consuming. Financial advisors need to stay upgraded with the most recent market fads, policies, and best practices to offer their clients properly. Despite these difficulties, being a licensed and certified monetary advisor uses immense benefits, consisting of many occupation chances and greater gaining potential.

The Best Strategy To Use For Pkf Advisory Services

Financial consultants work carefully with clients from diverse histories, assisting them browse complicated economic choices. The capacity to listen, comprehend their distinct needs, and provide tailored guidance makes all the distinction.

I started my job in corporate finance, relocating about and upward throughout the corporate money framework to sharpen skills that prepared me for the role I remain in today. My option to relocate from business finance to individual financing was driven by individual requirements in addition to the need to aid the lots of people, families, and little organizations I presently serve! Attaining a healthy work-life balance can be challenging in the very early years of an economic advisor's profession.

The monetary advisory profession has a favorable expectation. It is expected to go to my site expand and advance continuously. The task market for individual financial consultants is predicted to grow by i loved this 17% from 2023 to 2033, suggesting strong need for these services. This development is driven by elements such as an aging population needing retirement planning and increased understanding of the relevance of financial preparation.

Financial consultants have the distinct capacity to make a substantial influence on their clients' lives, aiding them achieve their monetary objectives and secure their futures. If you're passionate regarding financing and helping others, this job course may be the ideal fit for you - PKF Advisory Services. To find out more details about becoming a financial expert, download our thorough FAQ sheet

The Best Guide To Pkf Advisory Services

It does not have any financial investment recommendations and does not address any individual realities and scenarios. Thus, it can not be depended on as offering any kind of financial investment advice. If you would certainly such as financial investment suggestions concerning your particular truths and scenarios, please get in touch with a competent monetary consultant. Any kind of investment involves some degree of danger, and various sorts of financial investments include differing degrees of danger, consisting of loss of principal.

Past performance of any kind of protection, indices, approach or allowance may not be a sign of future results. The historical and existing information regarding guidelines, laws, guidelines or advantages contained in this paper view website is a summary of information obtained from or prepared by other resources. It has not been separately validated, yet was gotten from sources believed to be reliable.

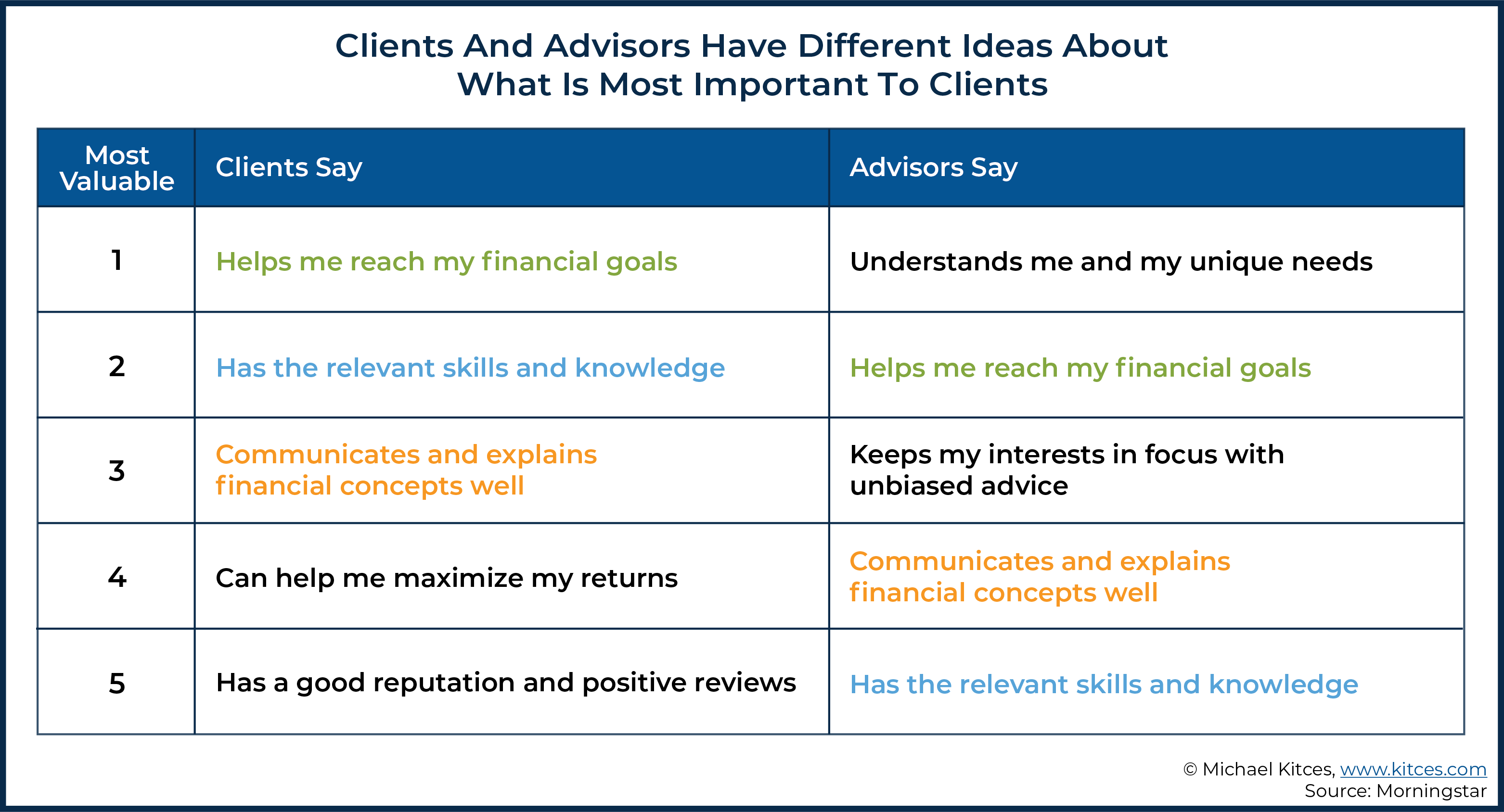

A monetary consultant's most beneficial asset is not know-how, experience, or also the capacity to create returns for customers - PKF Advisory Services. Financial specialists throughout the country we spoke with concurred that count on is the crucial to constructing enduring, effective relationships with clients.

Report this page